Since 2021, Canada, including regions like Fort McMurray, has faced the significant challenge of inflation. This economic concern, crucial for both policymakers and residents, has seen recent shifts. We’ll examine the current state of inflation in Canada, its trends, and the potential influence on future mortgage rates in Fort McMurray.

Examining Inflation in Canada

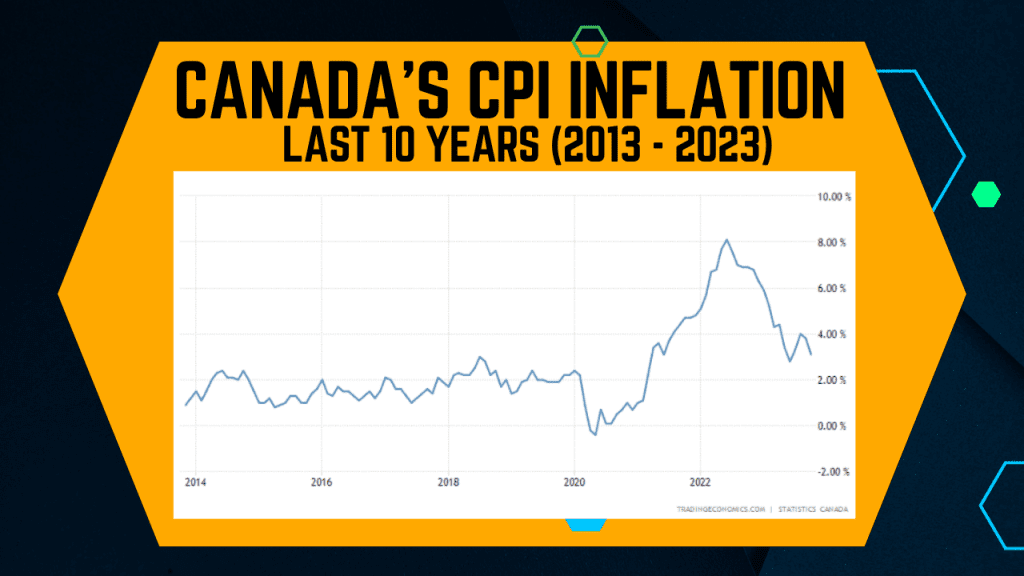

As October 2023 unfolded, the annual inflation rate in Canada was reported at 3.1%, a decrease from September’s 3.8%. This reduction, surpassing the predicted 3.2%, indicates a significant easing of inflation, driven largely by falling gasoline prices.

Source: Trading Economics

This trend, noticeable since spring, is crucial for regions like Fort McMurray, where the economy is closely tied to national trends. The annual average CPI in 2022 stood at 151.2, reflecting a steady decrease in price pressures that are relevant to both consumers and businesses in Fort McMurray.

The core inflation, stripping out volatile components like food and energy, also declined. This broad-based easing is vital for stable economic planning, especially for mortgage planning in Fort McMurray.

Bank of Canada’s Outlook

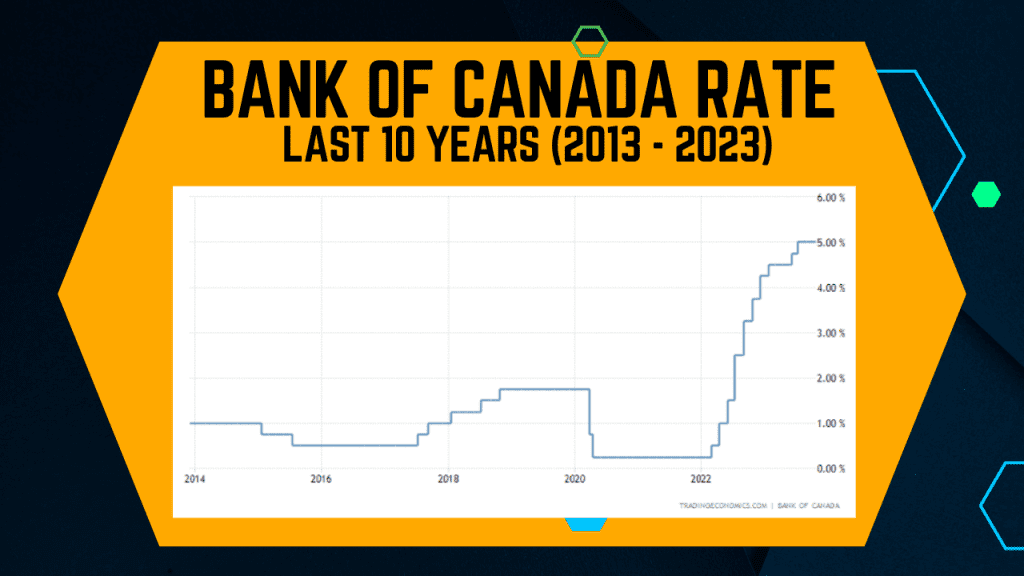

Earlier forecasts by the Bank of Canada anticipated inflation around 3.5% until mid-2024, with a gradual return to the 2% target by 2025. This ‘higher for longer’ approach indicates a slow but steady path towards target inflation rates.

This trend impacts the Bank’s monetary policy, which in turn influences mortgage rates in Fort McMurray. The Bank adjusts interest rates to manage inflation, directly affecting mortgage affordability and the housing market.

Inflation and Its Impact on Fort McMurray

The decreasing inflation rates, combined with the Bank of Canada’s projections, hint at a balancing economy. However, global and domestic factors, including housing and employment in Fort McMurray, bring their own set of challenges and opportunities.

Mortgage Renewals: A Fort McMurray Perspective

Mortgage renewals stand as a significant factor in Canada’s monetary policy direction. Economist David Rosenberg highlights the impact these renewals will have, particularly in mortgage-centric cities like Fort McMurray. With about two-thirds of Canada’s mortgages due for renewal soon, a shift from low pandemic-era rates to higher ones is expected.

Rosenberg’s projections, if current rates persist, suggest a substantial increase in average mortgage payments by 2024. This would notably reduce disposable income, affecting the local economy and consumer spending in Fort McMurray.

The Bank of Canada’s Rate Forecast

Recent economist polls suggest the Bank of Canada might pause its rate-hiking cycle, maintaining the current 5.00% rate. This development is key for those holding or considering mortgages in Fort McMurray, with expectations of rate reductions in the second quarter of 2024.

Source: Trading Economics

Recession Predictions and Policy Balancing

The Bank of Canada’s recent survey indicates the weakest economic conditions since the pandemic. The mixed opinions on a potential recession will influence interest rate decisions, directly impacting the mortgage landscape in Fort McMurray.

The Bank must balance inflation control against economic contraction risks and the impact of high-interest rates on households, a critical consideration for the Fort McMurray housing market.

Fort McMurray’s Mortgage Outlook

As 2024 approaches, the decisions of the Bank of Canada will greatly impact not just the national economy but also the specific context of Fort McMurray. Inflation stabilization and the impact of mortgage renewals are key factors.

Experts point to likely interest rate reductions by mid-2024, aiming to stabilize the economy and reach inflation targets. The path forward will depend on a mix of global and local factors, shaping the future of Fort McMurray’s mortgage rate market in a post-pandemic world.