As we step into 2024, the Fort McMurray real estate market may see reason for improvement. Fort McMurray hasn’t really seen the price increases that both Calgary and Edmonton have Price declines over the past years have made it easier for more people to get into home ownership.

Ten years ago, Fort McMurray had one of the most expensive housing markets in the country, but that shifted abruptly when oil prices retreated in 2014/15 and Fort McMurray’s housing market has seen a significant decline in prices since the oil boom of the early 2010s.

Melanie Galea, a real estate agent with RE/MAX in Fort McMurray, notes that prices have dropped by hundreds of thousands of dollars, although she recently shared with CBC that they are now beginning to level out.

An average detached home used to cost over $700,000 and a mobile home on it’s own land often sold for over $400,000. Today an average detached home sells for under $500,000 and mobile homes are under $200,000.

Lower Fort McMurray Mortgage Rates

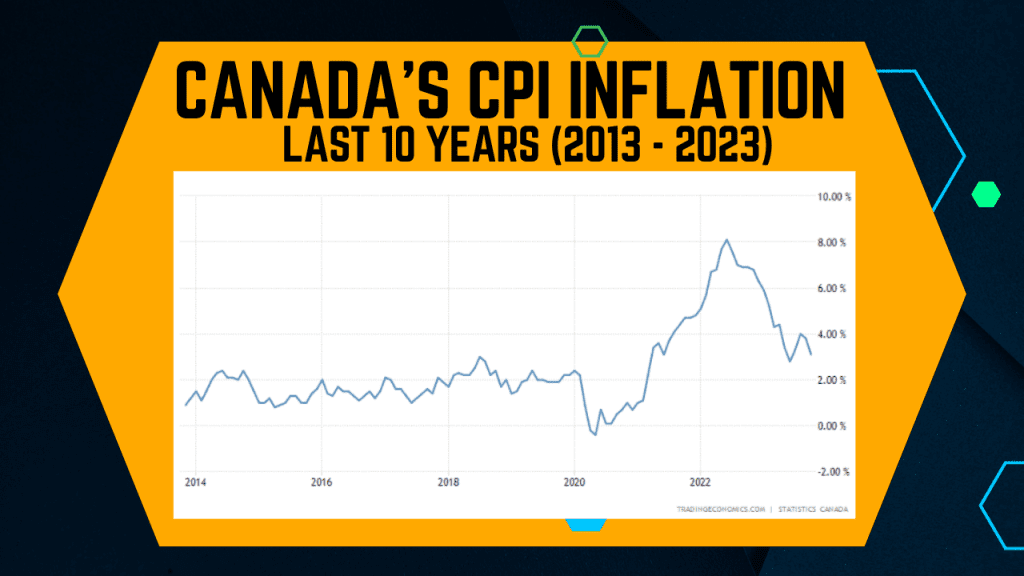

Inflation in Canada has been slowly coming under control. With this it allows the Bank of Canada to not only stop raising it’s rate, but also opens the door to lower rates soon.

2024 brings with it an expected reduction in mortgage interest rates. With the Bank of Canada set to lower rates, this could lead to increased buyer interest in the market. This shift is particularly relevant for markets like Fort McMurray, where the softening of prices might find stabilization and potentially a slight increase as lower rates encourage more buyers to enter the market.

Buying is Preferable to Renting

For many residents of Fort McMurray, the decision between buying and renting a home is more than just a matter of personal preference; it’s also an economic consideration. Despite volatile housing prices over the last several years, rents have continued to be expensive.

Kyle Wegner, a 32-year-old employee at Finning, an industrial equipment dealer specializing in Caterpillar products, is a prime example of this trend and he shared his story with CBC in November.

Wegner, who works at one of the mine sites near Fort McMurray, moved to town in August 2022. For him, the decision to buy a home was driven by the high rental costs in the area. “Rent is very high here, so for me, even in the short term, it’s almost saving a little bit of money,” Wegner explained.

This sentiment reflects a larger trend in the area where, despite the fluctuations in the housing market, buying often presents itself as a more financially viable option than renting.

According to a municipal census, the Wood Buffalo region has seen a drop in its population, primarily due to a significant decline in commuters. Initiatives like the Fort McMurray project, which aims to convince 1,000 families to move to the town, highlight the ongoing efforts to revitalize the community.

Despite these challenges, there is reason to be optimistic about the real estate market in Fort McMurray.

Conclusion

2024 presents a complex landscape for Alberta’s real estate markets. From Edmonton’s inventory crunch to Fort McMurray’s levelling prices, and changing mortgage rates affecting buyer interest, these factors are shaping diverse scenarios in McMurray and across the province. Understanding these trends is crucial for anyone looking to navigate these markets, whether for buying, selling, or refinancing a mortgage.

For more insights and updates on the Edmonton and Fort McMurray real estate markets, stay tuned to fortmcmurraymortgagebrokers.ca.