Governor Tiff Macklem of the Bank of Canada recently indicated a potential shift in monetary policy during an interview with BNN Bloomberg. This shift, expected to materialize in 2024, involves rate cuts that depend on a consistent decline in core inflation over several months. This represents a slight change in tone from his previous statement, which suggested it was too soon to consider reducing the policy rate.

As the Bank of Canada increases or decreases its policy rate, we see a direct impact on Fort McMurray Mortgage Rates as well as mortgage rates across the country.

Global Financial Alignment: Echoing the Federal Reserve

The Bank of Canada’s new stance aligns with global financial trends, particularly mirroring the approach of the United States Federal Reserve. The Federal Reserve has signalled a potential shift towards lowering interest rates as inflation targets are approached, indicating a common strategy among major central banks to adapt monetary policies in response to changing economic conditions.

Economic Indicators: A Cautious Approach to Rate Cuts

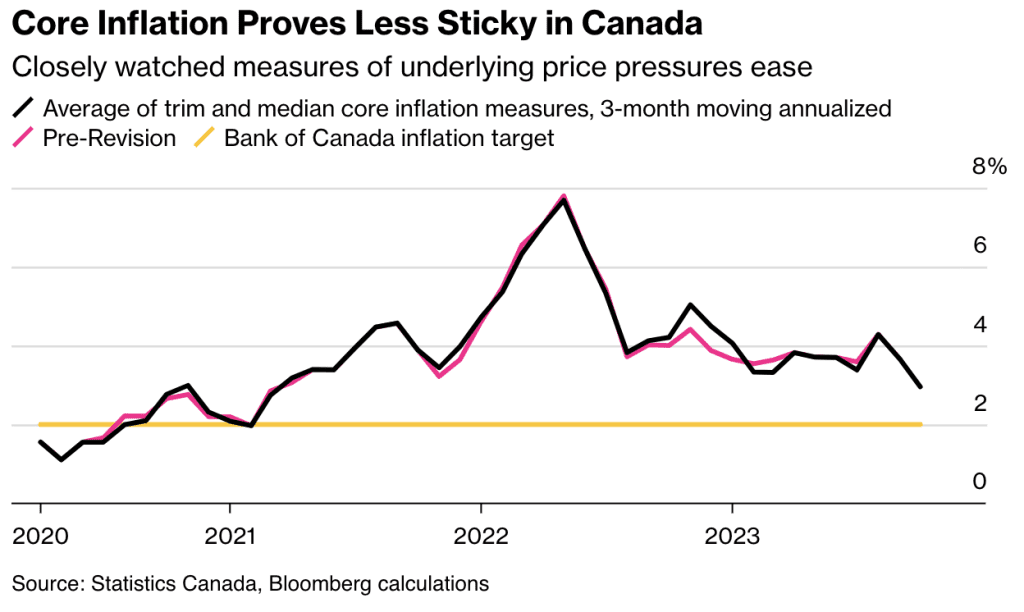

image source: Bloomberg

Despite observing a slowdown in core inflation rates, the Bank of Canada is not planning immediate rate cuts. October data showed key inflation measures falling within the bank’s target range, hinting at a cooling economy. However, Governor Macklem advises caution and emphasizes the need for more evidence before confidently moving towards a 2% inflation target. Market expectations suggest potential rate cuts as early as April 2024, but these are dependent on further economic indicators.

Monetary Policy and Market Reactions

Governor Macklem acknowledges the effectiveness of current monetary policies in achieving the 2% inflation target, maintaining a cautious stance. The market has begun to price in potential rate cuts by April 2024, reflecting confidence in the Bank’s inflation control strategy.

The Future of Interest Rates: Beyond Ultra-Low Rates

Governor Macklem and several experts believe that borrowing costs are unlikely to return to pre-pandemic lows, suggesting that the era of ultra-low interest rates is over. A consensus among economists and financial advisors supports this view. They predict that the lowest interest rates might reach around 2.5% but are unlikely to fall further. Lower rates could be ineffective in economic emergencies and might fuel an overheated housing market.

Challenging Traditional Monetary Policy Models

A study by economist Claudio Borio and colleagues at the Bank for International Settlements challenges traditional monetary policy models. It suggests that real interest rates are significantly influenced by central bankers’ decisions, rather than solely by economic factors like savings and investment decisions. This perspective supports the idea that the era of ultra-low interest rates was more of an anomaly and is less likely to be repeated in the near future.

Shifting Away from Extremely Low Interest Rates

These insights indicate a global financial shift, moving away from the exceptionally low interest rates that characterized the post-2008 period. This aligns with Macklem’s view that a return to the very low rates of the past decade is unlikely.